NFTs Enter a New Era

The NFT market has matured. What started as a speculative craze in 2021 has now become a structured digital asset class with clear leaders, stronger utility, and growing institutional adoption. In 2025, NFTs are more than collectibles—they’re tickets, memberships, digital art, gaming assets, and even financial instruments.

But opportunity and risk walk side by side. Investors need to balance excitement with caution to thrive in this rapidly evolving space.

This article delivers expert insights into NFT investment trends for 2025, highlighting top-performing collections and key caution points.

H1: NFT Investment Trends 2025 – Top Collections & Caution Points

H2: Big Shifts Defining NFTs in 2025

H3: Utility Over Hype

The market has shifted from “buy for hype” to “buy for utility.” NFTs now act as:

- Access passes to exclusive events or communities.

- Ownership rights in gaming and metaverse economies.

- Loyalty tools for brands to reward customers.

H3: Institutional Participation

Major brands, sports leagues, and financial institutions are integrating NFTs into long-term strategies. This adds legitimacy and drives mainstream adoption.

H3: Fractionalization & Accessibility

High-value NFTs are now sold in fractions, allowing everyday investors to own a part of premium assets without millions in capital.

H3: Regulatory Clarity

Governments are introducing clearer rules. While this adds compliance, it also reduces uncertainty for investors.

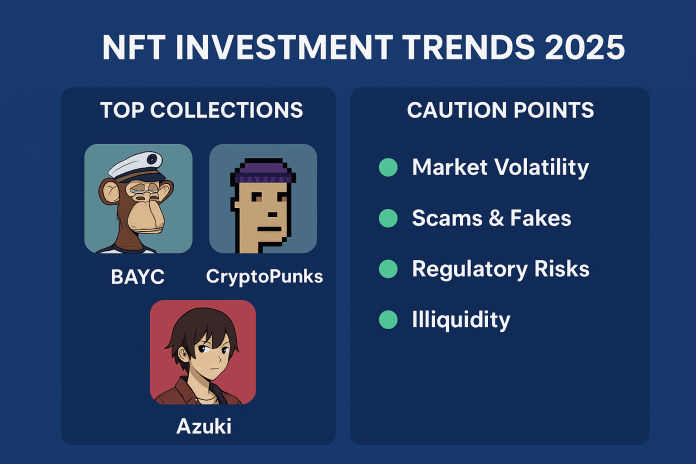

H2: Top NFT Collections to Watch in 2025

H3: Bored Ape Yacht Club (BAYC)

- Why It Matters: Still a cultural leader, BAYC continues to deliver utility through partnerships, real-world events, and metaverse integration.

- 2025 Outlook: More brand collaborations and Web3 experiences keep it relevant.

H3: CryptoPunks

- Why It Matters: The original NFT blue-chip. Valued for scarcity and historical significance.

- 2025 Outlook: Institutional collectors and museums are securing Punks as digital art history.

H3: Azuki

- Why It Matters: Anime-inspired art combined with community-driven storytelling.

- 2025 Outlook: Expanding into fashion and global pop culture.

H3: NBA Top Shot & Sports NFTs

- Why It Matters: Sports leagues are using NFTs as official digital memorabilia.

- 2025 Outlook: Integration with live games and metaverse arenas adds value.

H3: Gaming NFTs – Yuga Labs’ Otherside & ImmutableX Ecosystem

- Why It Matters: Gaming is where NFT utility shines—players own and trade assets.

- 2025 Outlook: Play-to-earn evolves into play-and-own, making assets both fun and valuable.

H3: Art Blocks

- Why It Matters: Generative art secured on blockchain.

- 2025 Outlook: Growing recognition from traditional art institutions cements long-term value.

H2: Caution Points – What Investors Must Watch

H3: Market Volatility

NFT prices remain unpredictable. Hype cycles can inflate values overnight but drop just as fast.

H3: Scams & Fakes

Despite improved verification, counterfeit NFTs and phishing attacks remain risks. Stick to verified platforms like OpenSea, Blur, and Rarible.

H3: Regulatory Risks

Global rules are evolving. Some countries may classify certain NFTs as securities, impacting how they’re bought or sold.

H3: Illiquidity

Unlike stocks or crypto, NFTs may take time to sell, especially lesser-known collections. Liquidity varies widely.

H3: Over-Reliance on Brands

Collections tied to a brand or celebrity may lose value if partnerships fade. Always assess community strength and long-term utility.

H2: Expert Insights – What Analysts Say

Research from Deloitte’s 2025 Tech Outlook and PwC’s Blockchain in Business Report confirms:

- NFTs are here to stay, but speculation is fading.

- Sustainable utility and institutional adoption drive long-term growth.

- Investors who diversify across art, gaming, and utility NFTs reduce risk.

Academic consensus also suggests that digital scarcity and verifiable ownership create durable value when paired with cultural relevance or real-world utility.

H2: NFT Investment Strategies for 2025

- Start with Blue-Chips: BAYC, CryptoPunks, and Art Blocks hold historical and cultural weight.

- Diversify: Don’t put all your capital into one collection—spread across art, sports, gaming, and utility NFTs.

- Evaluate Communities: Strong, engaged communities ensure longevity.

- Focus on Utility: Choose NFTs that unlock ongoing benefits (access, rewards, rights).

- Stay Updated: Regulations, partnerships, and new tech can rapidly shift the landscape.

H2: FAQs – NFT Investment Trends 2025

H3: Are NFTs still a good investment in 2025?

Yes—when chosen carefully. Blue-chip collections and utility-driven NFTs hold strong potential.

H3: What’s the safest way to buy NFTs?

Use trusted marketplaces, hardware wallets, and verify official project links.

H3: Which NFT sector has the most growth?

Gaming and utility NFTs are leading, supported by brand adoption and real-world integration.

H3: Can NFTs provide passive income?

Yes, some NFTs offer staking, royalty-sharing, or membership rewards.

H3: Will regulations kill NFT investments?

No—regulations bring clarity. They reduce fraud and attract institutional investors.

Conclusion – The Road Ahead for NFTs

NFTs in 2025 are smarter, stronger, and more secure. From iconic collections like BAYC and CryptoPunks to new frontiers in gaming and utility, the space is evolving into a sustainable ecosystem.

But success lies in balance:

- Embrace the excitement of top collections.

- Respect the caution points of volatility and risk.

- Invest with knowledge, not just emotion.

NFTs are no longer a trend—they’re a cornerstone of digital ownership. For those ready to engage wisely, 2025 offers some of the most exciting opportunities yet.

✅ Action Step: Begin by exploring verified NFT marketplaces, study community strength, and start with small, diversified investments to experience the future of digital ownership.