Stability in a Volatile World

Cryptocurrency markets move fast—sometimes too fast. Traders and investors crave stability amidst the storm. Enter stablecoins: digital assets pegged to fiat currencies like the US dollar. They bridge traditional finance with blockchain innovation, enabling faster transactions, reduced volatility, and greater global adoption.

But with dozens of stablecoins on the market, one question dominates 2025:

Is USDT still the king, or do rivals like USDC, DAI, BUSD, and others offer better long-term value?

This guide, crafted with insights from financial experts and industry research, breaks down the stablecoin landscape—helping you make secure, informed decisions.

What Are Stablecoins and Why Do They Matter?

Stablecoins are cryptocurrencies designed to maintain a 1:1 value peg with fiat currencies, typically the US dollar. Their importance lies in three pillars:

- Stability – Reduces volatility, making crypto usable for payments.

- Liquidity – Provides traders with a safe harbor during market swings.

- Global Access – Enables borderless, instant transactions without traditional banking delays.

Scientific and economic consensus supports that stablecoins increase financial inclusion, allowing people in inflation-prone countries to access dollar-backed assets securely.

USDT (Tether): The Giant That Started It All

Launched in 2014, Tether (USDT) remains the most widely used stablecoin. By 2025, it holds over $110 billion in circulating supply, dominating trading pairs across nearly every exchange.

Strengths of USDT:

- Unmatched liquidity across crypto markets.

- Accepted on almost every blockchain (Ethereum, Tron, Solana, Polygon).

- The first choice for traders moving large sums quickly.

Concerns Around USDT:

- Past transparency issues regarding reserves.

- Regulatory scrutiny in the U.S. and Europe.

Despite concerns, Tether has consistently maintained its peg and expanded its operations with real-time reserve reports, increasing user trust in recent years.

USDC (USD Coin): The Challenger

Backed by Circle and audited by U.S.-regulated institutions, USDC has built its reputation on trust and compliance.

Why Investors Love USDC:

- 100% backed by cash and short-term U.S. Treasuries.

- Fully regulated under U.S. financial law.

- Integrated with banking and fintech systems like Visa and Mastercard.

By 2025, USDC has become the go-to stablecoin for institutional investors who prioritize regulatory safety over speed.

DAI: The Decentralized Alternative

Unlike USDT and USDC, DAI is not controlled by a single company. Instead, it is governed by MakerDAO, a decentralized protocol.

DAI’s Unique Edge:

- Fully decentralized and censorship-resistant.

- Backed by crypto collateral (ETH, USDC, others).

- A favorite among DeFi users.

However, DAI’s stability can be tested during extreme market volatility, since it relies on over-collateralization and smart contracts. Still, in 2025, it remains a symbol of decentralization and financial freedom.

Other Contenders: BUSD, TUSD, and Emerging Stablecoins

- BUSD (Binance USD): Once a strong rival, regulatory pressure forced it into decline by 2024.

- TUSD (TrueUSD): Offers real-time attestations but struggles with adoption.

- Algorithmic Stablecoins: After the Terra-LUNA crash in 2022, confidence remains low, though new models are being tested cautiously.

By 2025, the market favors fiat-backed stablecoins with transparency over experimental designs.

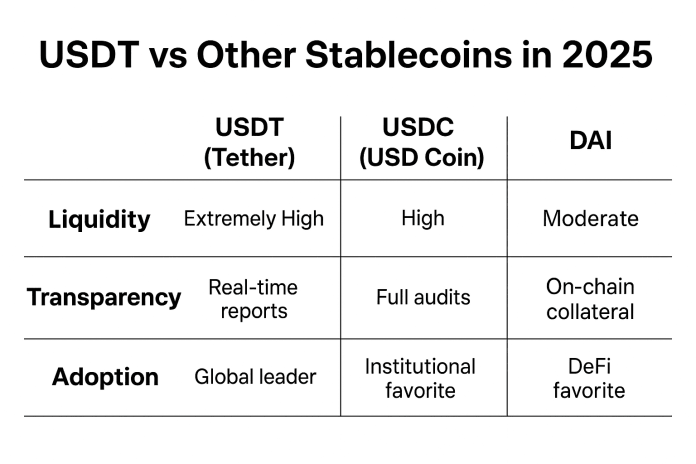

Comparing USDT vs Other Stablecoins (2025 Snapshot)

FeatureUSDT (Tether)USDC (USD Coin)DAIOthers (TUSD, etc.)Market CapLargest (~$110B)Second ($35B)Smaller (~$5B)VariesLiquidityExtremely HighHighModerateLowRegulationOffshore, increasing auditsU.S. regulatedDecentralized governanceMixedAdoptionGlobal leaderInstitutional favoriteDeFi favoriteLimitedTransparencyReal-time reportsFull auditsOn-chain collateralCase by caseBest Use CaseTrading & transfersInstitutions & complianceDeFi & Web3Niche

Which Stablecoin is the Best Investment in 2025?

The answer depends on your goals:

- For Traders: USDT remains unbeatable in liquidity and availability.

- For Institutions: USDC offers compliance and regulatory backing.

- For Decentralization Enthusiasts: DAI stands strong as the trusted DeFi coin.

Expert Consensus (2025):

- Holding a diversified mix of USDT, USDC, and DAI balances liquidity, compliance, and decentralization.

- Avoid putting all funds into one stablecoin—spread risk across reliable projects.

Risks to Consider

Even stablecoins are not risk-free. Investors should understand:

- Regulatory shifts could affect availability.

- Black swan events (like Terra-LUNA) highlight systemic risks.

- Centralization vs decentralization trade-offs matter depending on your values.

Frequently Asked Questions (FAQs)

- Is USDT safe to use in 2025?

Yes. While past controversies existed, Tether now publishes real-time reserve data, maintaining confidence among traders.

- Which stablecoin is most transparent?

USDC leads in transparency with full third-party audits and U.S. regulation.

- Is DAI safer than centralized stablecoins?

DAI offers decentralization but can face volatility during extreme crypto market crashes.

- Can stablecoins earn passive income?

Yes. Platforms and DeFi protocols allow you to stake or lend stablecoins for yields, though risks vary.

- Should I diversify across stablecoins?

Experts recommend diversification across USDT, USDC, and DAI to minimize risk.

Conclusion: The Future of Stablecoins

Stablecoins are no longer just a niche tool—they are the backbone of digital finance. In 2025, USDT remains the liquidity giant, USDC is the compliance champion, and DAI continues to prove the value of decentralization.