A New Era of Energy Investing

The world is shifting from fossil fuels to cleaner, smarter energy solutions. Electric vehicles (EVs), solar power, and wind energy are no longer fringe technologies—they’re at the center of global growth. For investors, energy-focused ETFs offer a practical, diversified, and cost-effective way to ride this transformation.

This guide, shaped by expert analysis and global investment consensus, highlights strategies to maximize returns while minimizing risks. It balances excitement with clarity, giving you tools to make informed decisions in one of the most dynamic sectors today.

Why Energy ETFs?

ETFs (Exchange-Traded Funds) pool a collection of stocks, bonds, or assets into a single tradable security. For energy, this means instant access to:

- Renewable leaders in solar, wind, and hydrogen.

- EV manufacturers and battery innovators.

- Utility companies transitioning to green power.

- Global exposure without single-stock risk.

By investing in an energy ETF, you’re not betting on one company—you’re embracing an industry-wide evolution.

Top Strategies for Energy ETF Investments

1. Focus on EV Ecosystem ETFs

Electric vehicles are driving exponential growth. ETFs targeting EVs often include carmakers like Tesla, BYD, or NIO, along with suppliers of lithium, rare earth minerals, and charging networks.

Strategy Tip: Look for funds that balance automakers with supporting industries (battery technology, semiconductor chips). This reduces reliance on one company’s performance.

2. Choose Pure-Play Renewable ETFs

Pure renewable ETFs provide direct exposure to solar, wind, and clean utilities. They’re often more volatile but can deliver high growth during green energy expansion phases.

Strategy Tip: For long-term portfolios, mix pure-play renewables with broader clean-energy ETFs to smooth volatility.

3. Balance Developed and Emerging Markets

Asia, Europe, and North America lead the renewable push, but emerging markets in Africa and Latin America offer untapped potential.

Strategy Tip: Pick ETFs with a global mandate. This balances stable returns from developed markets with higher upside in growth economies.

4. Watch Government Policies & Incentives

Energy markets are deeply tied to regulation. EV subsidies in China, Europe’s Green Deal, and U.S. tax credits are major drivers.

Strategy Tip: Align ETF investments with regions offering pro-renewable policies. Political support often accelerates stock growth.

5. Diversify Across Energy Technologies

Solar and EVs dominate headlines, but hydrogen fuel cells, bioenergy, and smart grids are rising fast. ETFs covering multiple technologies provide broader exposure.

Strategy Tip: Avoid overconcentration—no single technology has a guaranteed path to dominance.

6. Factor in ESG (Environmental, Social, Governance)

Investors worldwide are prioritizing sustainable investing. Energy ETFs with strong ESG scores attract institutional money, boosting stability.

Strategy Tip: Favor ETFs with clear ESG screening for long-term trust and performance.

7. Use Dollar-Cost Averaging (DCA)

Volatility in energy markets is high. DCA—investing fixed amounts at regular intervals—smooths out price swings and reduces risk.

Strategy Tip: Commit to a monthly or quarterly investment schedule, regardless of short-term market moves.

8. Monitor Energy Prices & Commodity Trends

Although renewables dominate, many ETFs still hold traditional energy companies in transition. Commodity price spikes can affect short-term returns.

Strategy Tip: Stay updated on oil, lithium, and natural gas markets to anticipate ETF movements.

9. Consider Thematic & Niche ETFs

Some ETFs zoom in on specific themes—like lithium miners, solar energy, or grid technology. They can deliver explosive growth but carry higher risk.

Strategy Tip: Use niche ETFs for satellite positions in your portfolio, not core holdings.

10. Align Investment Horizon with Energy Cycles

Energy transitions take decades. Short-term volatility is normal, but the long-term trend is upward.

Strategy Tip: Treat energy ETFs as long-term growth plays—perfect for retirement accounts or wealth-building portfolios.

Risks to Keep in Mind

- Policy Shifts: Subsidies may change with political cycles.

- Technology Risks: Not all clean technologies succeed commercially.

- Valuation Bubbles: Green stocks often run ahead of fundamentals.

- Commodity Supply Chains: Lithium shortages or trade disputes can disrupt EV growth.

Managing risk through diversification and disciplined allocation is key.

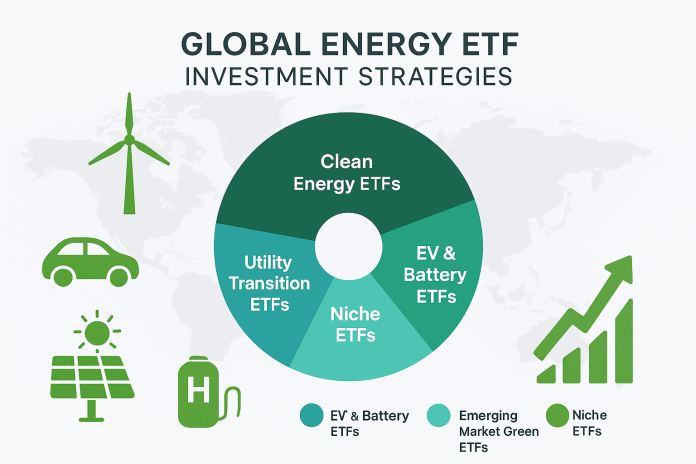

Sample ETF Portfolio Allocation

- 40% Core Clean Energy ETF (broad exposure to renewables).

- 25% EV & Battery ETF (focusing on growth in mobility).

- 15% Utility Transition ETF (stable dividends from evolving power companies).

- 10% Emerging Market Green ETF (higher growth potential).

- 10% Niche/Experimental ETF (hydrogen, solar, lithium).

Why Now Is the Time to Invest

- EV adoption is accelerating, with projections of 60% global sales by 2035.

- Renewables are expected to supply 50% of electricity by 2040.

- Global policy commitments (Net Zero by 2050) ensure long-term growth.

Investors who act now position themselves at the forefront of the greatest industrial transition of our century.

Frequently Asked Questions (FAQs)

Q1: Are renewable energy ETFs safe for beginners?

Yes. Broad-based renewable ETFs are well-suited for beginners, offering diversification and exposure to growth industries.

Q2: What’s the difference between an EV ETF and a clean energy ETF?

EV ETFs focus on electric vehicles and their supply chains, while clean energy ETFs cover solar, wind, hydrogen, and utilities.

Q3: How much should I allocate to energy ETFs in my portfolio?

Experts suggest 10–20% allocation, depending on risk tolerance and long-term goals.

Q4: Do energy ETFs pay dividends?

Some do—especially those holding utilities. Growth-focused ETFs often reinvest profits instead of paying dividends.

Q5: Can energy ETFs outperform the S&P 500?

Yes, especially during strong policy support or commodity supercycles. However, they may also experience sharper downturns.

Conclusion: Invest With Confidence in the Green Future

Global energy ETFs provide the perfect gateway to participate in the renewable revolution. By focusing on EVs, clean power, and sustainable technologies, investors can align portfolios with powerful global trends while managing risks wisely.